In 2024, we were very demure, reveled in brat summer, and dove into morning shed routines. It was the year that the intersection of the 170+ million Americans on TikTok collided with Amazon, driving oversized results. According to Statista, Amazon's monthly US revenue in beauty and personal care sales is estimated to range from $2.4 to 3.8 billion in 2024 and was one of Amazon's most profitable product categories.

Market Defense, a global marketplace agency empowering premium beauty brands to dominate on Amazon and beyond, uncovered the top 10 beauty brands of 2024 by sales share—and what’s fueling their success. From strategic focus areas to bold moves that drive growth and capture market share, these brands are redefining what it means to thrive on Amazon. Get the inside scoop on how they’re winning big and setting the standard for the beauty category on Amazon, with actionable tips to grow your own brand from the Market Defense team of experts.

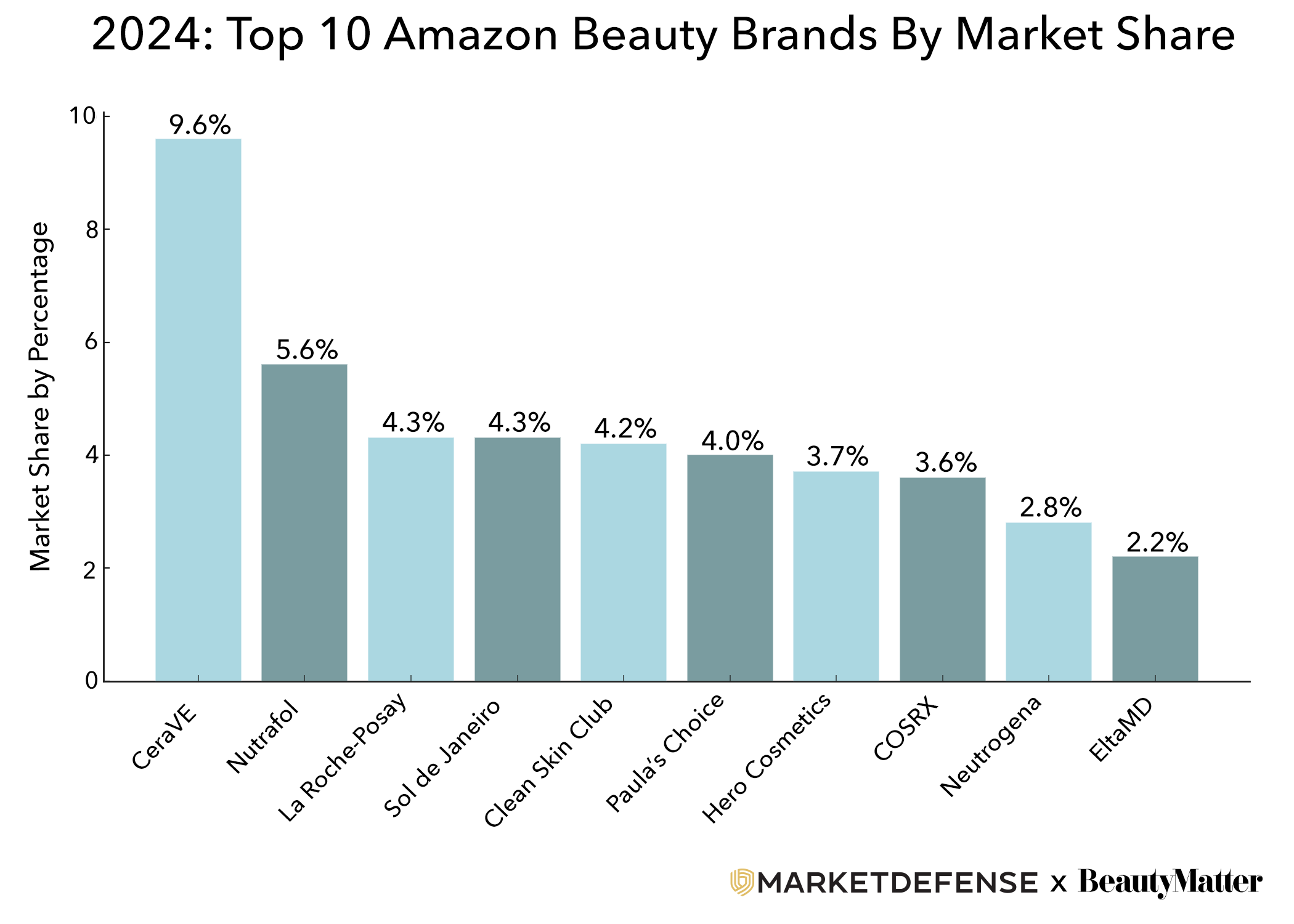

Top 10 Brands by Share of Sales

CeraVe 9.6% share of sales: The skincare brand founded in 2005 by Tom Allison was acquired from Valeant Pharmaceuticals International by L'Oréal in 2017. The product range of affordable dermatologist-backed formulas has been transformed from a fledgling brand to Gen Z’s go-to for skincare, becoming a TikTok viral sensation, with hashtag #cerave amassing billions of views. CeraVe reportedly sold one unit of product every two seconds during Amazon’s Prime Day 2 for 2024. Outside Amazon, the brand is sold at most mass retailers and drug stores.

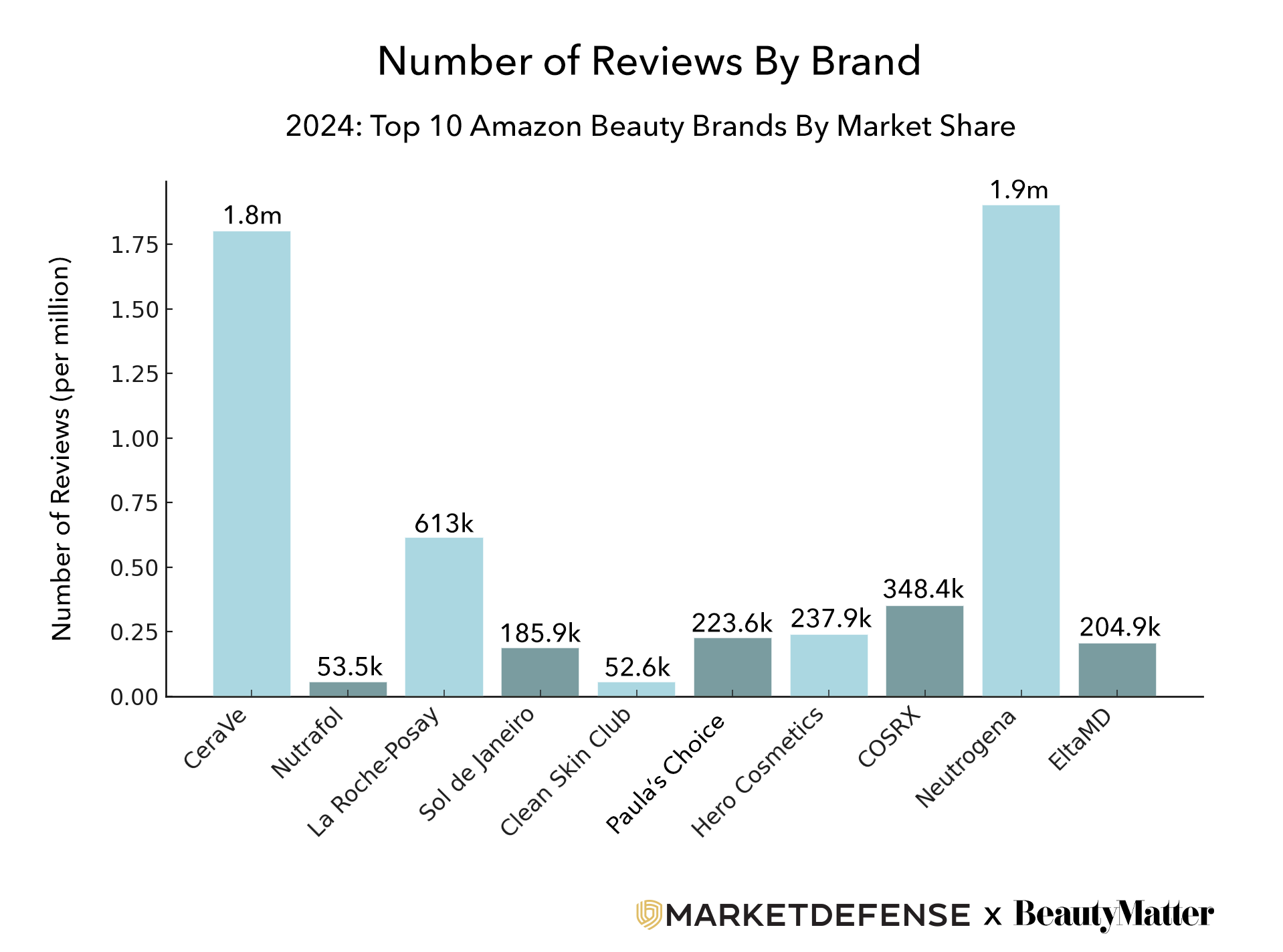

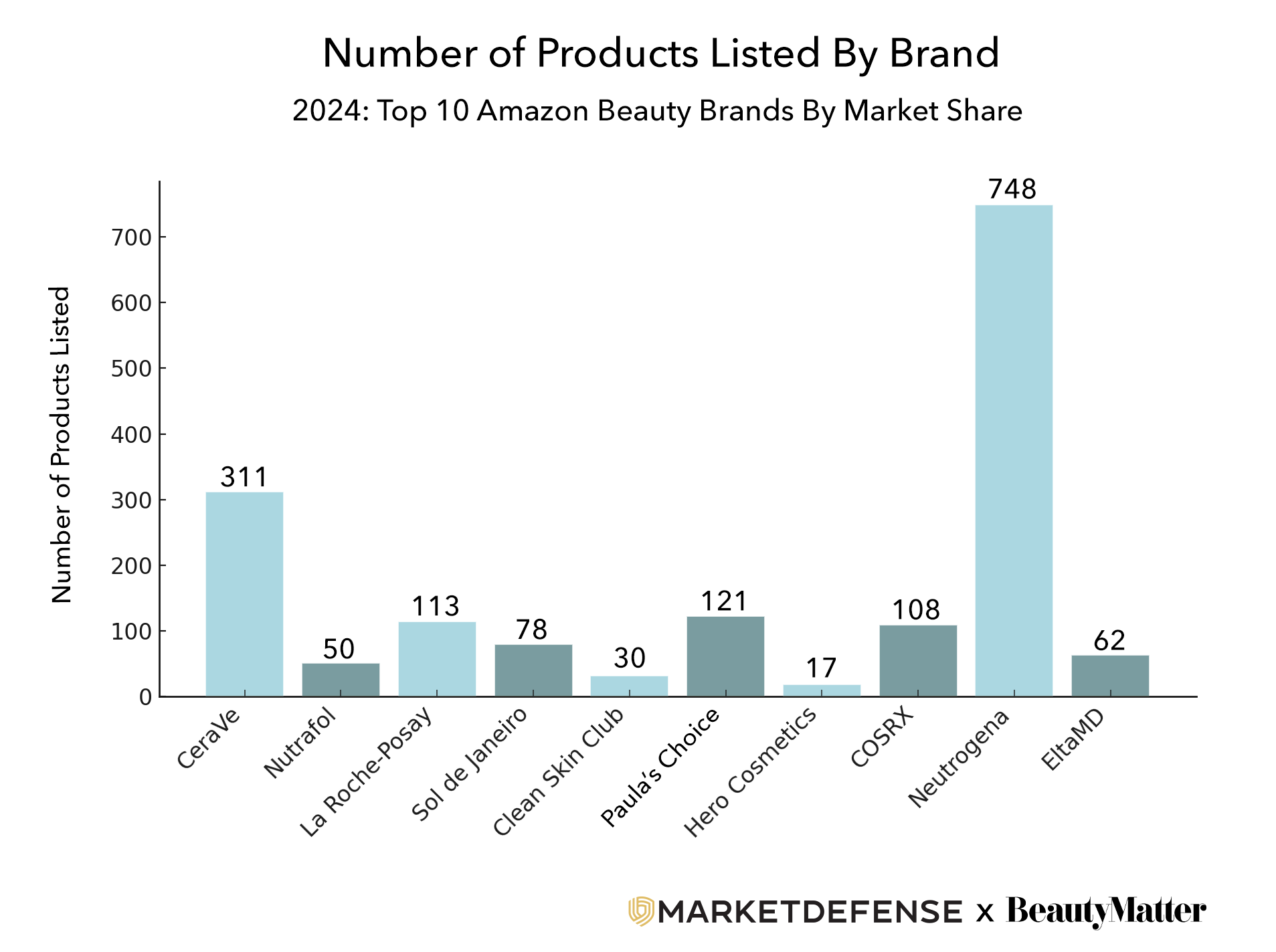

Winning Formula: Second only to e.l.f., CeraVe stands out as the most visible beauty brand on Amazon, bolstered by millions of monthly searches (1.1 million every month alone for “CeraVe Face Wash”). With 1.8 million reviews and the second-largest assortment of 311 products of the brands on this list, its Amazon presence is undeniable. In 2023, the brand had six products regularly featured in Amazon’s Top 25 selling beauty and personal care; by Q4 2024, that number had dropped to one. While CeraVe may have lost some ground to the viral hits that have dominated the list, its products remain consistent bestsellers, backed by reliable quality and strong media campaigns.

The Data:

Nutrafol 5.6% share of sales: The company was co-ofounded in 2016 by Giorgos Tsetis and Roland Peralta and acquired by Unilever in 2022 for an estimated $1.2 billion. It has tripled its turnover, launching into retail with Sephora selling and entering China through cross-border commerce. Nutrafol pioneered a whole-body approach to address key root causes of hair thinning and shedding with physician-formulated, nonGMO, clinically tested drug-free supplement formulas.

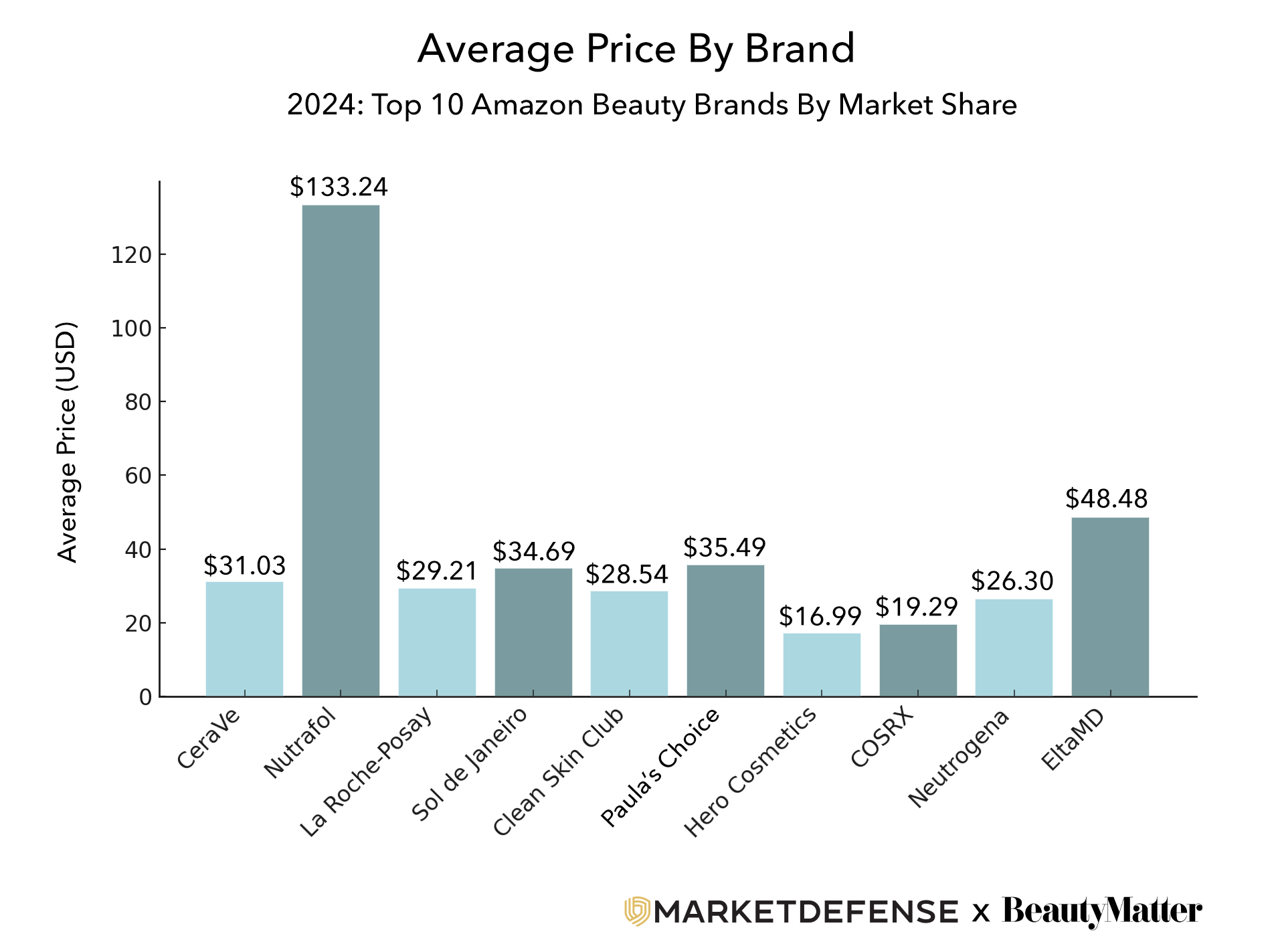

Winning Formula: Riding the momentum of Hair Loss & Growth—Amazon beauty's fastest-growing category of 2023—Nutrafol made waves with its $88 “Women's Balance Hair Growth Supplement,” which entered the Amazon Top list in Q3 2024 as the highest-priced item on the Top 25 list since BeautyMatter tracking began in 2021. With the highest monthly revenue among the top 10 brands at $23 million, supported by an average price of $133.24, its success is driven by impactful TV commercials and a societal shift toward openly addressing women’s hair loss, particularly related to menopause.

The Data:

La Roche-Posay 4.3% share of sales: The brand was founded in 1975 with the mission to develop skincare products using unique thermal water that would provide dermatologists with effective skincare solutions for their patients, especially those with sensitive skin. La Roche-Posay claims to be the #1 dermocosmetic brand worldwide, recommended by 90,000 dermatologists and sold in over 60 countries. L'Oreal acquired the skincare brand in 2018.

The Winning Formula: The fourth most visible brand organically and the second-largest share in skincare, trailing only CeraVe, La Roche-Posay is thriving by owning the #1 face moisturizer on Amazon. With hydration ranking as the top skincare need among Amazon Beauty shoppers, dominating this subcategory positions the brand for success across the entire beauty category. Winning in skincare on Amazon means setting the stage to lead the beauty space as a whole.

The Data:

Sol de Janeiro 4.3% share of sales: Co-founded in the US in 2015 by Heela Yang, Camila Pierotti, and Marc Capra, Sol de Janeiro is a results-driven premium bodycare brand born from an authentic Brazilian philosophy of celebration and joy. In 2021, the company sold an 83% stake to L'Occitane in a transaction valued at $450 million. Building on the success of hero products like Brazilian Bum Bum Cream and Cheirosa perfume mists, the brand has successfully expanded into haircare and fragrance. The business is a top-selling brand at Sephora, and its fragrance is a viral phenomenon fueling projected sales of more than $1 billion.

Winning Formula: Ranked as the eighth most visible brand organically, "Sol de Janeiro" saw 1.8 million monthly searches in 2024, making it the fifth most popular search term in Amazon Beauty. Its $32 Skin Care Set holds the #1 spot in its category—a smart entry point for new customers to try three products at an accessible price, encouraging repeat purchases of full-sized items at higher price points. Bundles like these not only boost average order value (AOV) but are also easier to execute effectively when managing your own 3P account, as this brand does.

The Data:

Clean Skin Club 4.2% share of sales: A first-of-its-kind brand at the intersection of skincare and hygiene founded in 2019 by Ben-David Imberman and Mor Shnaider, Clean Skin Club was inspired after hearing an aesthetician complain about bacteria-laden towels. With that, the direct-to-consumer (DTC) brand launched its flagship Clean Towels XL, marking the first dermatologist-approved, single-use, and 100% USDA biobased facial towel on the market. The brand claims to be clinically shown to improve overall skin health while reducing oiliness, redness, and skin sensitivity. Clean Skin Club landed a $32 million investment at the end of last year to fund brick-and-mortar expansion.

Winning Formula: This brand first broke into the Top 25 in Q1 2023 at #25 and made an impressive climb to #2 by Q2 2024. It entered the list with 10,000 reviews and tripled that within a year. Clean Skin’s XL towels became the top sponsored item of 2024 in Beauty. Being the top sponsored item means its product appeared as the first result in Amazon’s sponsored product listings, giving it maximum visibility and significantly boosting potential sales. This prime placement comes with a higher investment, but for Clean Skin, it’s clearly paying off in spades. Amazon searches for "Disposable Face Towels” rose 183% year over year (YoY) in 2024.

The Data:

Paula's Choice 4.0% share of sales: Paula’s Choice was a pioneer of science-backed products and DTC e-commerce. Founded by Paula Begoun in 1995, the brand is famous for its industry-leading innovation, accessible jargon-free science, high-performing ingredients, and cruelty-free products. In 2021, Unilever acquired Paula’s Choice from TA Associates for a rumored $2 billion. The brand lives under the Unilever Prestige umbrella and has become one of Unilever’s Power Brands.

Winning Formula: Ranked sixth in sponsorship activity and boasting the third top sponsored item of the year, Paula’s Choice 2% BHA Liquid Salicylic Acid Exfoliant has been a consistent Top 25 performer since we began tracking in 2021. Its strategy leverages a mix of accessibility and value, offering both a $11 1-ounce trial size and a $35 4-ounce full size. By providing an affordable entry point, the brand continuously attracts new customers to its product. In a crowded space, selling a trial size at a low price—even at a loss—pays off, as the product delivers visible results that convert first-time buyers into loyal customers.

The Data:

Hero Cosmetics 3.7% share of sales: Hero Cosmetics is an acne and skin solutions brand launched in 2017 on Amazon with one Mighty Patch Original product. In 2022, Church and Dwight acquired Hero Cosmetics in a $630 million deal. Hero Cosmetics has expanded beyond the pimple patch category, creating innovative solutions for every pimple problem. From post-acne healing to prevention to daily protection to bodycare, Hero Cosmetics has grown into a comprehensive range of skin solutions.

Winning Formula: Hero dominates the search term “Pimple Patches,” which saw 1.7 million monthly searches in 2024, making it the third biggest beauty-related term of the year. The brand’s flagship product, The Original Mighty Patch, holds the #1 spot in Facial Treatments & Masks and ranks #2 overall in Beauty & Personal Care. It was also the sixth top sponsored item of the year, highlighting its significant investment in maintaining prime placement. However, this investment is paying off with strong organic traction from Amazon’s algorithm. With an average price of $16.99—the lowest on this list—the brand has little room for error, making strategic keyword targeting essential to avoid wasted spend and maximize its margins.

The Data:

COSRX 3.6% share of sales: Founded in 2013, COSRX is a K-beauty brand with eight product lines distributed and known for affordable and effective solutions. COSRX is a global sensation available in over 146 countries. In 2021 Amorepacific entered into an investment agreement to secure minority shares of COSRX and pursue joint projects. One of COSRX’s most iconic product lines is its TikTok-famous Advanced Snail products, which consist of Advanced Snail 96 Mucin Power Essence and Advanced Snail 92 All in One Cream.

Winning Formula: COSRX ranks as the seventh highest brand in beauty category sponsorship activity of 2024, indicating a steady investment in maintaining prime placements without overspending. In 2024, the brand was the #3 skincare brand, with its Snail Mucin 96 Power Serum achieving incredible milestones: it was the ninth top sponsored item of the year, the #1 selling beauty item during 2024 Prime Day, and it currently holds the #1 spot among facial serums. The Snail Mucin serum essentially kicked off the K-beauty domination of 2024 and has maintained its leadership, paving the way for other rising stars like Laneige and Tirtir to reach similar success on Amazon.

The Data:

Neutrogena 2.8% share of sales: Neutrogena, founded in 1930 under the name Natone, became a prestige beauty brand in America on its California vibe and dermatologists’ recommendations. In 1994, Johnson & Johnson bought Neutrogena for almost $1 billion, leaning into science-backed innovation and accessible education to democratize skin health by addressing skin needs across ages, skin types, and tones. Kenvue acquired Neutrogena when Johnson & Johnson spun off its consumer health division into Kenvue in 2023.

Winning Formula: Neutrogena leads with the largest assortment on this list at 748 products, reflecting a significant investment that places it as the second highest brand in sponsorship activity. This strategy pays off with its position as the third most visible brand organically. A standout product, Neutrogena’s Makeup Remover Ultra-Soft Cleansing Towelettes, has consistently ranked among the top 5 best-selling beauty items on Amazon for years. To maximize average order value (AOV) and meet customer expectations for convenience, Neutrogena only sells these in multipacks. For daily-use products like this, offering multipacks at a value price is essential to drive repeat purchases and sustain customer loyalty.

The Data:

EltaMD 2.2% share of sales: Its origins go back to the 1800s in rural Switzerland with a healing ointment that farmers passed down for generations evolving into a wound-care company in 1988. In 2007, the business' medical heritage and science-backed formulas became the EltaMD brand we know today. EltaMD claims to be the #1 dermatologist-recommended professional sunscreen brand in the US. Colgate acquired EltaMd in 2017.

Winning Formula: During Prime Day 2024 week, "sunscreen" became the fastest-growing trend across TikTok's beauty categories, amassing 5.4 billion views—a 99.8% increase month-over-month—and became the most searched term in Amazon’s Skin Care category. EltaMD capitalized on this consumer shift by dominating sales, with four of the top ten selling sunscreens on Amazon. The brand’s strategic focus on a single hero SKU, offering variations like tint and formulation without compromising on quality, has made it synonymous with sunscreen on Amazon. This sharp focus has led to strong organic rankings, driving momentum across its entire product lineup.

The Data:

What the Top 10 Brands of 2025 Have in Common—and How You Can Achieve Their Level of Success

Organic Ranking: The top ten brands focused heavily on their hero SKUs, securing #1 rankings that provided high visibility and served as a gateway to the rest of their product lines. Rather than spreading ad spend across all SKUs, they concentrated their efforts, avoiding dilution. This all-in hero strategy resulted in coveted badges like Amazon’s Choice, #1 Best Seller, or Overall Pick, which not only sustains visibility but also leverages Amazon's algorithm to work in their favor, driving ongoing growth and discovery.

Dave Karlsven, SVP of Client Marketing and Data Science at Market Defense, said, "Badges on Amazon serve as visual trust signals for shoppers. When customers see labels like ‘Best Seller’ or ‘Limited-Time Deal,’ it instantly communicates value, popularity, or urgency. It’s not just a marketing flourish—these badges can dramatically increase click-through rates and conversion rates because they reduce decision friction and increase visibility to help your product stand out from the customers in a way that Amazon is validating. In the competitive beauty category, earning and leveraging badges can really help a brand stand out."

Control: Brands like the top ten often face challenges with maintaining control—rapid growth and increasing awareness can lead to unauthorized sellers capitalizing on their momentum. However, these top-performing brands are taking smart steps to retain control over their customer relationships. By managing their own accounts or selling directly to Amazon, eliminating resellers, and ensuring full authority over their imagery, content, and messaging, they safeguard their brand integrity and deliver a consistent consumer experience.

Shelley Swallow, VP of Brand Protection at Market Defense, said “To maintain channel control on Amazon for brands this size, it all starts with the supply chain. Maintaining control of your supply chain and control over your distributors and authorized retailers both international and domestic will help keep your listings clean from resellers. Assortment can also play a big part in controlling resellers. Designating Amazon exclusives or bundles that are only sold through you on Amazon allows you to maintain control over your account and give the Amazon shopper an exclusive experience when shopping your brand on Amazon.”

High Prices, High Quality: All the top brands position themselves as prestige players within their category, even when offering accessible price points. Amazon customers are drawn to prestige beauty brands, valuing quality and reputation. As the customer journey evolves, luxury has taken on a new definition—one that prioritizes convenience. Amazon meets this demand perfectly, becoming an essential part of modern luxury shopping.

Vanessa Kuykendall, Chief Engagement Officer, Market Defense, said “There’s a lingering misconception that Amazon is just for low-priced products—but that’s outdated thinking. Market Defense has launched many premium and luxury brands on Amazon, and I can confidently say customers are drawn to high value and exceptional quality. They’re not afraid of paying a premium price; what they fear is being sold "hope in a jar." That’s why their first stop is always the reviews. If you want to compete with the top ten brands, prioritize your customers. Check in regularly, listen to their feedback, and focus on improving and elevating your offering. Don’t shy away from constructive criticism—it’s your key to staying ahead.”

Consistent Growth: All the top brands are achieving steady month-over-month growth, a strategy Amazon rewards over sudden spikes, which can create an unpredictable roller coaster that the platform doesn’t favor. Even leaning heavily into tentpole events can backfire without a clear plan to convert the influx of new customers into sustained, long-term growth.

Dave Karlsven: "Brands should think beyond seasonal spikes and plan a more holistic, year-round approach. Budgeting for 2025 means anticipating higher ad costs, allocating funds for testing new ad formats (like Amazon Live or Sponsored Display), and building flexibility into the budget to capitalize on emerging channels like TikTok.”

Average Brand Rating: These brands consistently maintain an average rating above 4 stars, a testament to how effectively they manage their account health. On Amazon, a brand's average rating reflects overall customer satisfaction, calculated using a sophisticated algorithm. This algorithm factors in more than just the average of all reviews—it considers the recency of reviews, whether the purchase was verified, and the depth of the review itself. This strong rating showcases their ability to deliver quality products and customer experiences that keep them at the top.

Amy Rudgard, SVP Client Delivery, Market Defense said, “Testimonials and endorsements are highly influential on Amazon. We’ve seen how positive reviews can boost sales revenue and know that shoppers are 2-3X more likely to purchase a product with one review vs. no review. Strong ratings go hand in hand with minimizing returns which is also important to Amazon success. It’s key to consider using Vine, but it’s also important to analyze your product reviews. Our growth teams use these insights to strengthen brands' PDP pages by understanding what users love or find frustrating about a product. Brands can use this information to make product or packaging improvements that will drive greater satisfaction and reduce returns on the platform."

Streamlined Assortments: While Neutrogena (748 SKUs) and CeraVe (311 SKUs) stand out with larger product ranges, the rest of the top brands keep their assortments tight, with fewer than 125 SKUs. Smaller assortments allow for more efficient allocation of ad spend, avoiding dilution across too many products. To replicate their success, focus on hero SKUs as your customer acquisition drivers. This strategy not only attracts more customers but also ensures your ad budget is used effectively and aligns with your off-Amazon marketing message.

Dave Karlsven: "There are thousands of ways people search for beauty products on Amazon, but in each beauty category we know exactly which 10% of keywords and products are driving 90%+ of the sales and which ones our clients should and should not focus on that will drive the majority of their sales growth and profits. We don’t guess and test to gather data with our clients’ ad budgets to try to learn what might work to hopefully drive growth in the future."